RALEIGH, NC (February 10, 2017) - Ben Wilson, Director of Lending and Acquisitions, arranged another Helvetica loan to provide quick funding to 3 tech entrepreneurs to acquire a bank-owned, 33,378 square foot, vacant office building just outside Raleigh, NC. The borrowers negotiated a discounted purchase at a TenX auction, below cost to build and with a significant upside for added value to the project. Traditional bank financing was not available for this asset because: it was 100% vacant, had no operating income, unstabilized, needed a quick closing, and was bank-owned.

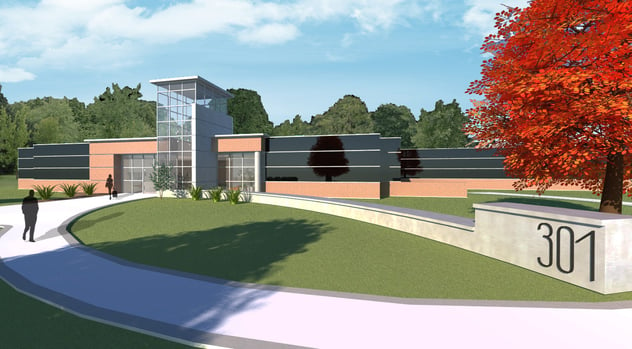

The subject property is located in Cary, NC just 12 miles southwest of downtown Raleigh and part of the Raleigh-Druham MSA. The property is an area known as the ‘Research Triangle’, so called due to the shape formed by the area’s three major research universities - North Carolina State University in Raleigh, Duke University in Durham, and the University of North Carolina in Chapel Hill. Located in the center of this area is the largest research park in the United States, Research Triangle Park (RTP). According to Office of State Budget and Management of North Carolina, the Triangle area has been the fastest-growing metro area in North Carolina since 2000. The Triangle’s continued growth is due to it being one of the most highly educated and diverse workforces in the nation. The area’s success can be attributed to its quality and quantity of educational institutions.

The borrowers purchased the bank-owned property from an online auction platform, TenX.com. They needed quick bridge financing to close on the purchase. The borrower intended to market the property for lease and then once stabilized, apply for conventional bank financing. The property was previously owner-occupied and after the recession, the company struggled to pay their debt. In 2015 the bank was eventually forced to foreclose. Due to the distressed nature of the sale, the borrowers believed they purchased the asset at a deep discount.

The borrower intends to develop the adjacent property with a multi-tenant office building. Vacancy is less than 10% in the immediate area. The new building would be ideally situated between a large Siemens office park, a flagged hotel and an adjacent office building with an incoming publicly traded owner-occupant.

With great coordination by Vijay Chandran, an Investment Banker with the Cauvery Group, Helvetica was able to quickly underwrite a $1.467 million bridge loan in a short amount of time enabling the borrowers to capitalize on a unique investment opportunity.

Deal Highlights

- Bank-owned auction sale

- Value add investment

- 100% Vacant

- No operating income

- Non-recourse

- Quick close

- Bridge Loan

Have a loan like this?

About Helvetica

The Helvetica Group is a a real estate investment bank and family office providing innovative private lending, distressed asset acquisitions, brokerage, investment management and family office services. Helvetica aggregates investor capital in pursuit of greater alpha by targeting diligently underwritten, alternative investments secured by real estate assets. Helvetica is a direct lender and invests on behalf of individual investors, trusts, pension plans, retirement funds and institutional investors. We work closely with brokers, bankers, lenders and financial advisors as strategic partners to provide clients with fast access to financing, affording them the opportunity to quickly leverage their real estate assets. The Helvetica Group and its affiliates provide alternative financing secured by a variety of property types including: residential, retail, office, apartments, storage, RV parks, mobile home parks, light industrial, mixed use and other special use properties.