HOLLYWOOD, CA - Helvetica provided a $1.7 million bridge loan to refinance a looming balloon payment on a mixed use, retail building in Los Angeles, CA. The loan was originated by a local mortgage broker who reached out to Helvetica requesting a quick closing. The borrower wanted to sell the property but first needed to make several renovations to the building. Helvetica stepped in and quickly funded the stabilization loan and provided cash out for the borrower to make the necessary property improvements.

Recent Posts

HELVETICA FUNDED LOAN | $1.7 MILLION BRIDGE LOAN TO MIXED-USE, RETAIL BUILDING IN HOLLYWOOD, CA

HELVETICA FUNDED LOAN | SMALL BALANCE REFINANCE OF CHURCH IN LOS ANGELES, CA WITH LOOMING MATURITY

LOS ANGELES, CA (February 2, 2017) - Ben Wilson, Director of Lending and Acquisitions, arranged for another Helvetica small balance commercial loan refinance of a Church building in Los Angeles. A non-profit organization has owned the building for over 30 years and was facing a looming maturity. Inconsistent income, credit challenges, low cash balances and a quick closing, made this loan an unlikely candidate for a traditional bank loan.

The mortgage broker brought the loan request to Helvetica after having several successful alternative loan closings. Confidence in closing, process transparency, and common sense underwriting gave the borrower and broker certainty in execution. "We continue to fund high equity loans when banks say no. We have several church borrowers in our portfolio and welcome the opportunity to fund bank turn downs when the loan to value is below 60%," said Chad Mestler, CEO of Helvetica Group.

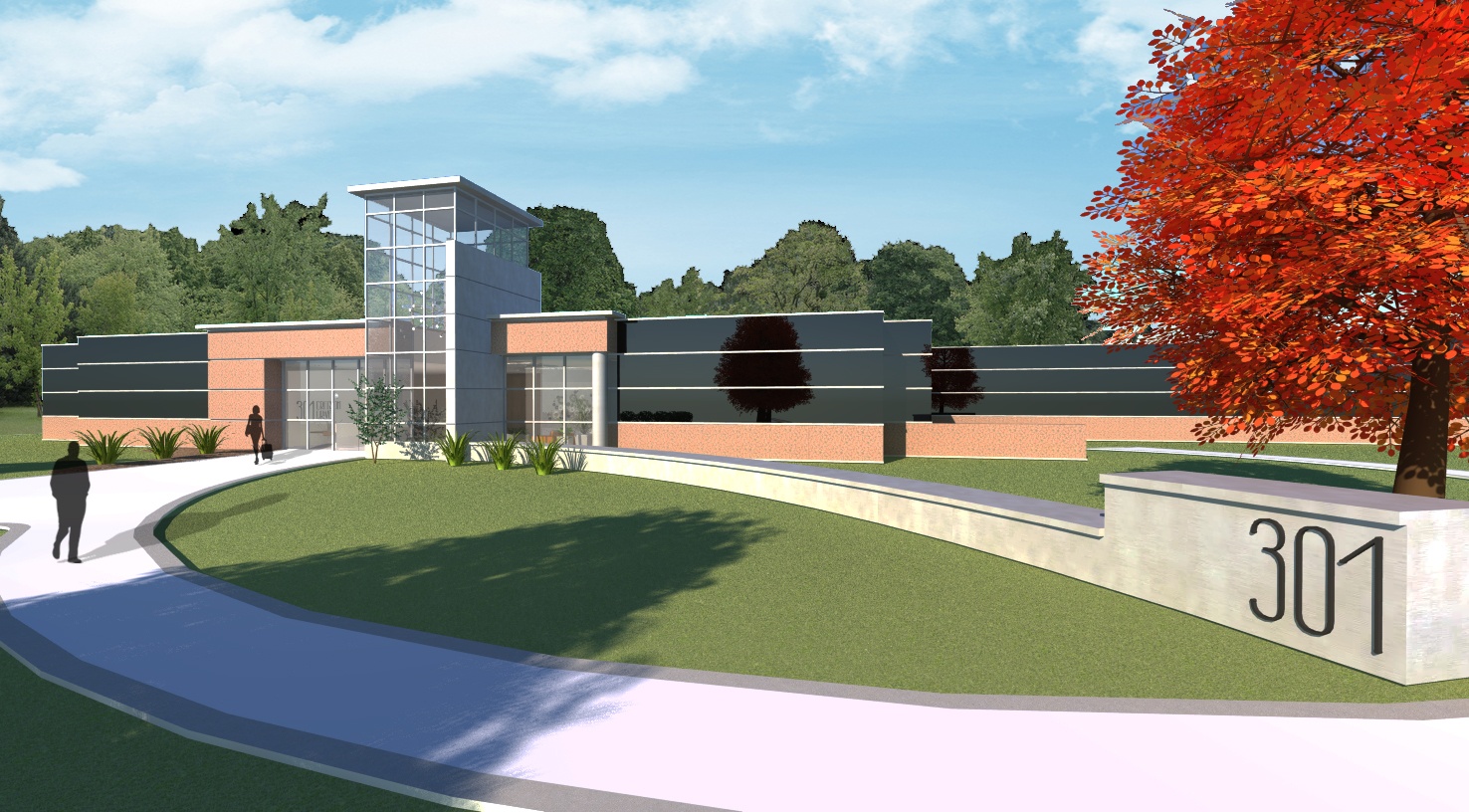

HELVETICA FUNDED LOAN | $1.467 MILLION FOR AUCTION PURCHASE OF BANK-OWNED OFFICE BUILDING IN CARY, NC

RALEIGH, NC (February 10, 2017) - Ben Wilson, Director of Lending and Acquisitions, arranged another Helvetica loan to provide quick funding to 3 tech entrepreneurs to acquire a bank-owned, 33,378 square foot, vacant office building just outside Raleigh, NC. The borrowers negotiated a discounted purchase at a TenX auction, below cost to build and with a significant upside for added value to the project. Traditional bank financing was not available for this asset because: it was 100% vacant, had no operating income, unstabilized, needed a quick closing, and was bank-owned.

The subject property is located in Cary, NC just 12 miles southwest of downtown Raleigh and part of the Raleigh-Druham MSA. The property is an area known as the ‘Research Triangle’, so called due to the shape formed by the area’s three major research universities - North Carolina State University in Raleigh, Duke University in Durham, and the University of North Carolina in Chapel Hill.