Recent and Looming Bank Failures Require Diligent Monitoring

Now more than ever it is important to support local banks that can demonstrate financial viability and responsible risk management.

Let's not send money and empower the "big 4" to the detriment of our much needed community and regional banks. Too much control in the hands of a few is no bueno.

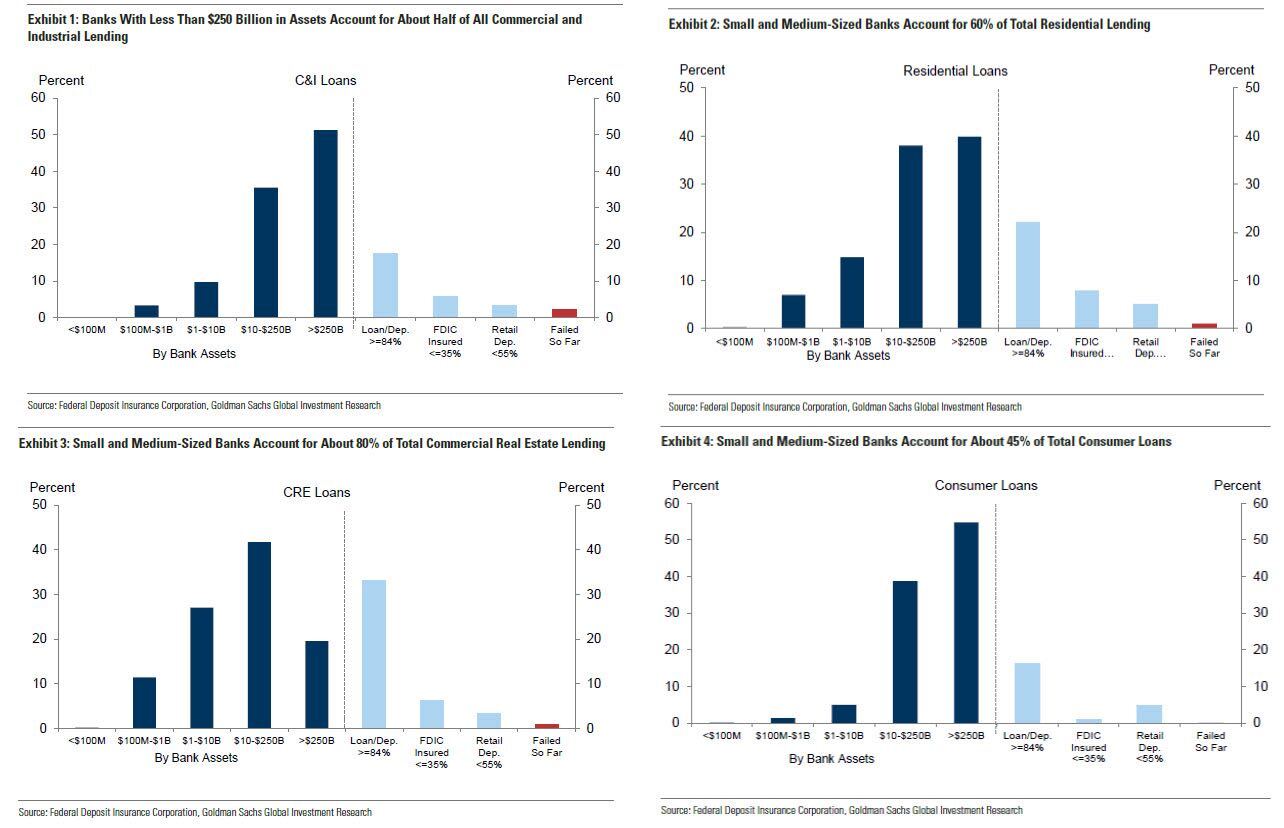

Small/medium banks account for 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending. @zerohedge

Protecting Your Deposits

Some ways we are mitigating banking risk for our real estate investment funds while also supporting our local bankers?

- IntraFi Network: Ask your community banker about participating in the IntraFi Network to insure deposits over $250K; a global network of financial institutions that allows for the seamless transfer of funds between member banks.

- Short term treasuries: Consider TreasuryDirect. gov to purchase short term treasuries e.g., 4 weeks. It's easy to link your bank account and purchase short term treasuries directly. Yields from recent auctions of 4-Week T-Bills were close to 5%.

- Diversify banking relationships: spread your funds among several regional and community banks. Great way to benchmark services and make new friends.

IntraFi Network

The IntraFi Network is a global network of financial institutions that allows for the seamless transfer of funds between member banks. Some of the benefits of the IntraFi Network include:

-

Faster transaction processing: IntraFi Network allows for faster transaction processing and settlement times, as funds can be transferred between banks in real-time. This can help to improve the efficiency of cross-border payments and reduce the time it takes for payments to be processed.

-

Increased security: IntraFi Network uses advanced security measures to ensure that all transactions are secure and protected against fraud. This can help to reduce the risk of unauthorized transactions and provide peace of mind for both banks and their customers.

-

Lower transaction costs: IntraFi Network allows member banks to offer lower transaction fees for international payments. This can help to reduce the cost of cross-border payments for customers and encourage more international trade and commerce.

-

Improved transparency: IntraFi Network provides greater transparency in the payment process, allowing customers to track their payments in real-time and receive notifications when payments are completed. This can help to improve customer trust and confidence in the payment system.

-

Increased access to new markets: IntraFi Network provides member banks with access to new markets and customers around the world. This can help to facilitate international trade and commerce and promote economic growth.

-

Greater convenience: IntraFi Network provides greater convenience for customers, allowing them to send and receive payments in different currencies and across different borders with ease. This can help to simplify the payment process and reduce the administrative burden on businesses.

These benefits can help to improve the efficiency of cross-border payments, reduce transaction costs, and facilitate international trade and commerce.

Short Term Treasury Bills

Investing directly in government bonds to manage idyll cash is another way to safeguard cash. Consider TreasuryDirect.gov to purchase short term treasuries e.g., 4 weeks. It's easy to link your bank account and purchase short term treasuries directly. Yields from recent auctions of 4-Week T-Bills were close to 5%.

Consider Multiple Banking Relationships

Spread your funds among several regional and community banks. This is a great way to benchmark services and make new friends. Using multiple banking relationships can provide several benefits, including:

-

Diversification: By using multiple banking relationships, a business can spread its banking activities across different banks, reducing its exposure to any single bank. This can help mitigate the risk of financial loss in the event of a bank failure or other financial disruption.

-

Access to different services and products: Different banks offer different services and products, and by using multiple banking relationships, a business can access a wider range of financial products and services. This can help a business to find the most suitable products for its needs, such as loans, lines of credit, or merchant services.

-

Negotiating leverage: Having multiple banking relationships can give a business negotiating leverage when it comes to obtaining better pricing or terms on financial products and services. Banks may be more willing to offer favorable terms to businesses that have multiple banking relationships, as they will want to retain the business.

-

Competitive rates and fees: By using multiple banking relationships, a business can compare rates and fees from different banks and choose the most competitive options. This can help a business to save money on banking fees and interest rates.

-

Reducing concentration risk: By using multiple banking relationships, a business can reduce its concentration risk, which is the risk of relying on a single bank for all of its financial activities. This can help ensure that the business has access to multiple sources of funding and is not overly reliant on any single bank.

-

Improved customer service: Having multiple banking relationships can improve customer service, as banks will compete to retain the business. This can lead to more personalized service, faster response times, and more attentive support.

By leveraging multiple banking relationships, a business can optimize its financial management and reduce its financial risk exposure.