DLT and crypto wallet adoption

The world of cryptocurrencies has evolved rapidly in recent years, and with it, the way we think about money and assets. The rise of blockchain technology and decentralized finance (DeFi) has brought us to the cusp of a financial revolution. The rise of crypto wallets and the potential they hold for tokenizing real assets poses the likely possibility of fiat currency becoming obsolete.

The Evolution of Cryptocurrency Wallets

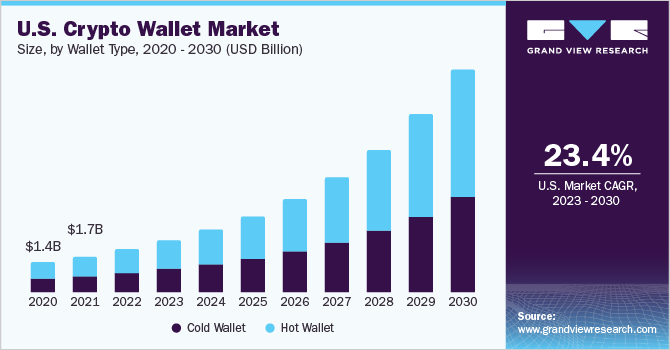

Crypto wallets have come a long way since the early days of Bitcoin. Today, they are no longer just a means to store and transfer digital assets; they have evolved into comprehensive financial management tools. The global crypto wallet market size was estimated at USD 8.42 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.8% from 2023 to 2030. One of the fundamental growth drivers for the market is the widespread adoption of cryptocurrencies as a legitimate asset class. The next phase in their evolution could involve the tokenization of real assets, such as real estate, stocks, and commodities.

Tokenization of Real Assets

Tokenization is the process of converting real-world assets into digital tokens that can be traded on blockchain networks. This concept is gaining traction for several reasons:

a. Fractional Ownership: Tokenization allows for the division of large, expensive assets into smaller, more affordable units. This opens up investment opportunities to a broader range of people.

b. Transparency: Blockchain technology ensures transparency and immutability, reducing fraud and errors associated with traditional asset ownership records.

c. Liquidity: Tokenized assets can be traded 24/7, providing liquidity that is often lacking in traditional markets.

d. Accessibility: Tokenization can remove barriers related to geographical location and regulatory restrictions, allowing global access to investment opportunities.

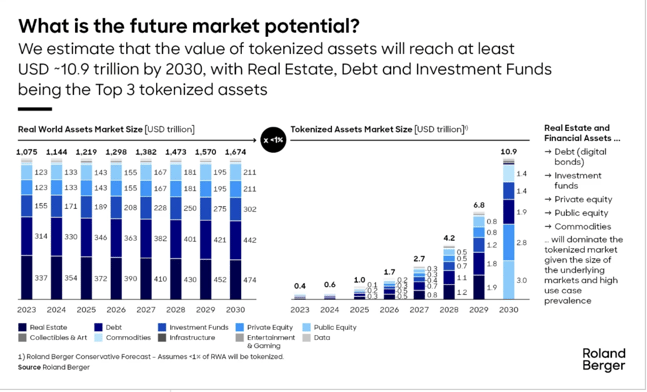

Real-World Use Cases: A $10.9 Trillion Market

Let's consider a few real-world use cases of how tokenization of assets could revolutionize the financial landscape:

a. Real Estate: Instead of buying an entire property, individuals can purchase tokenized fractions, enabling them to invest in real estate with a lower entry cost.

b. Stocks and Bonds: Companies can issue digital tokens that represent shares, making it easier for investors to buy, sell, and trade securities.

c. Art and Collectibles: Tokenization allows art and collectibles to be easily divided and traded, making it simpler for art enthusiasts to invest in high-value pieces.

d. Commodities: Tokenized assets could include precious metals, oil, and other commodities, providing a convenient way to invest in physical goods.

The Path to Obsolescence for Fiat Currency

As more real assets become tokenized, the need for traditional fiat currency diminishes. Here's how this process might unfold:

a. Payment Methods: With tokenized assets in your crypto wallet, you can use them for everyday transactions, just like using cash or a credit card. Cryptocurrencies like Bitcoin and stablecoins could become the preferred means of exchange.

b. Cross-Border Transactions: International payments will become instantaneous and borderless, eliminating the need for costly currency exchange services and reducing transfer fees.

c. Digital Banks and Ecosystems: Traditional banks might struggle to keep up with the pace of change. Digital banks and decentralized financial ecosystems will likely become the go-to platforms for managing your tokenized assets.

d. Decentralization: A decentralized financial system could displace central banks and traditional financial institutions, further eroding the dominance of fiat currency.

Challenges and Considerations

While the prospect of an asset-tokenized future is exciting, there are challenges to overcome:

a. Regulatory Hurdles: Governments and central banks will be reluctant to relinquish control to the individual and concede to the inability to manipulate markets.

b. Security: As more assets are tokenized, the risk of cyberattacks and fraud increases. Robust security measures are paramount.

c. Education: Widespread adoption of asset tokenization will require a concerted effort to educate people on how to use and manage digital assets.

So What's Next?

The future of crypto wallets is not limited to the storage of digital currencies but extends to the tokenization of real assets. As this trend continues to gain momentum, it could pave the way for the obsolescence of traditional fiat currency. While challenges remain, the benefits of transparency, accessibility, and liquidity associated with tokenized assets make this an exciting and transformative prospect for the world of finance. The financial landscape is evolving, and it's time for us to embrace the future of crypto wallets and digital assets.