HELVETICA FUNDED LOAN | SMALL BALANCE BRIDGE LOAN ON TWO FLORIDA MULTIFAMILY PROPERTIES

HELVETICA FUNDED BRIDGE LOAN ON MULTIFAMILY PROPERTY IN LONG BEACH, CA

Topics: Deals, Loans, Small Balance

Organization: The Key to Closing Commercial Real Estate Loans Faster!

Closing loans quickly can often seem like an unreachable goal. However, there are some tips and tricks to keep the wheels of the loan machine turning and churning in the right direction, with an end goal of faster closing for your client's loans. They all center around the basic idea of:

HELVETICA FUNDED LOAN | $1.7 MILLION BRIDGE LOAN TO MIXED-USE, RETAIL BUILDING IN HOLLYWOOD, CA

HOLLYWOOD, CA - Helvetica provided a $1.7 million bridge loan to refinance a looming balloon payment on a mixed use, retail building in Los Angeles, CA. The loan was originated by a local mortgage broker who reached out to Helvetica requesting a quick closing. The borrower wanted to sell the property but first needed to make several renovations to the building. Helvetica stepped in and quickly funded the stabilization loan and provided cash out for the borrower to make the necessary property improvements.

HELVETICA FUNDED LOAN | SMALL BALANCE REFINANCE OF CHURCH IN LOS ANGELES, CA WITH LOOMING MATURITY

LOS ANGELES, CA (February 2, 2017) - Ben Wilson, Director of Lending and Acquisitions, arranged for another Helvetica small balance commercial loan refinance of a Church building in Los Angeles. A non-profit organization has owned the building for over 30 years and was facing a looming maturity. Inconsistent income, credit challenges, low cash balances and a quick closing, made this loan an unlikely candidate for a traditional bank loan.

The mortgage broker brought the loan request to Helvetica after having several successful alternative loan closings. Confidence in closing, process transparency, and common sense underwriting gave the borrower and broker certainty in execution. "We continue to fund high equity loans when banks say no. We have several church borrowers in our portfolio and welcome the opportunity to fund bank turn downs when the loan to value is below 60%," said Chad Mestler, CEO of Helvetica Group.

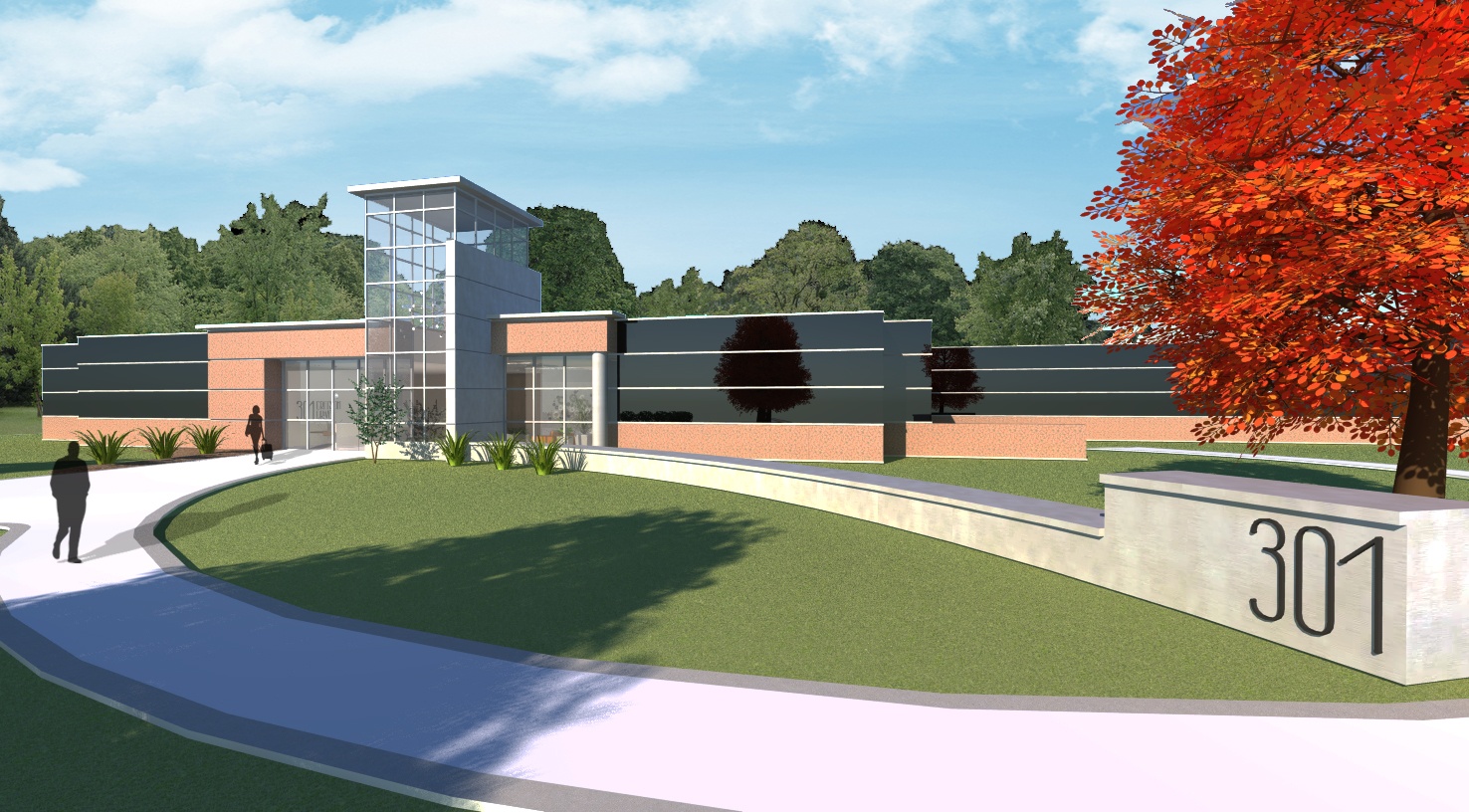

HELVETICA FUNDED LOAN | $1.467 MILLION FOR AUCTION PURCHASE OF BANK-OWNED OFFICE BUILDING IN CARY, NC

RALEIGH, NC (February 10, 2017) - Ben Wilson, Director of Lending and Acquisitions, arranged another Helvetica loan to provide quick funding to 3 tech entrepreneurs to acquire a bank-owned, 33,378 square foot, vacant office building just outside Raleigh, NC. The borrowers negotiated a discounted purchase at a TenX auction, below cost to build and with a significant upside for added value to the project. Traditional bank financing was not available for this asset because: it was 100% vacant, had no operating income, unstabilized, needed a quick closing, and was bank-owned.

The subject property is located in Cary, NC just 12 miles southwest of downtown Raleigh and part of the Raleigh-Druham MSA. The property is an area known as the ‘Research Triangle’, so called due to the shape formed by the area’s three major research universities - North Carolina State University in Raleigh, Duke University in Durham, and the University of North Carolina in Chapel Hill.

HELVETICA ACQUIRES VACANT ED WHITE HOSPITAL IN ST. PETERSBURG, FL AS ADAPTIVE REUSE INVESTMENT

ST. PETERSBURG, FL (December 31, 2015) - Chad Mestler, CEO of Helvetica Group, arrannged for the purchase of a vacant hospital, formerly known as the Ed White Hospital in St. Petersburg, FL. This 6 story, 121,000 sq. ft. building is an ideal opportunity for an adaptive reuse development. Ideally suited for assisted living, senior housing, veterans housing, immigrant children housing, single resident occupancy or multifamily. The neighborhood of Kenwood is a very desirable residential area in St. Petersburg, Florida. Kenwood is located just 2 miles from downtown St. Petersburg, and 15 minutes from downtown Tampa.

HELVETICA FUNDS $450,000 REFINANCE OF MATURING DEBT SECURED BY CHURCH IN LOS ANGELES, CA

LOS ANGELES (August 3, 2016) - Helvetica refinanced a recently matured private money loan. The borrower was a non profit that owned a chuch building located in Los Angeles. The transaction was structured with a 20 year amortization and a 7 year maturity which enabled the borrower to payoff the existing debt as well as lower their monthly payment.

HELVETICA FUNDED LOAN | $1 MILLION SECURED BY THREE LUXURY RESIDENTIAL PROPERTIES IN LA JOLLA, CA

LA JOLLA, CA (November 30, 2016) - The Helvetica Group provided a low loan-to-value bridge loan secured by one junior trust deed on three luxury single family homes located in prestigious neighborhoods in La Jolla, CA. The homes were non-owner occupied investment properties and were in excellent locations. The loan was to a sucessful tech entrepreneur and the proceeds were to be used to provide venture debt to an early stage biotech company.

HELVETICA FUNDS $1.9 MILLION CRE LOAN TO REFINANCE BALLOON PAYMENT ON RAMONA OFFICE BUILDING

RAMONA, CA (September 30, 2015) - Helvetica funded a loan secured by a two story, 24,960 square foot, multi-tenant office/retail building in Ramona, CA. Helvetica provided a $1,900,000 loan to refinance the borrower’s maturing debt. The borrower purchased the land nearly 15 years ago and received a bank loan after completing the construction of the building in 2003. During the economic downturn, a few tenants vacated the building causing the property value to decline. The borrower negotiated a forbearance agreement with the existing lender who later accepted a discounted payoff. The borrower refinanced with a private money lender and that loan came due. The broker was unable to find a traditional loan: banks were unwilling to finance the property even though there was plenty of equity.

The broker earned $19,000 and was able to save the borrower from foreclosure.

Topics: Deals

.png)